Technological innovation is rapidly improving products and driving growth across the consumer audio industry, according to Kavish Patel, Research Analyst at Futuresource, who delivered the opening presentation at the Audio Collaborative 2024 conference in London today.

Patel presented a wide breadth of market data and analysis based on Futuresources’s annual Consumer Home Audio Market report including industry growth figures, consumer preferences and trend identification.

He highlighted five key insights:

Consumer audio can expect 4% growth in 2024.

The consumer audio market is predicted to increase 4% from $81bn to $85bn a year from 2023 to 2024, driven by the headphones segment which represents 67% of the market and is growing at 7%.

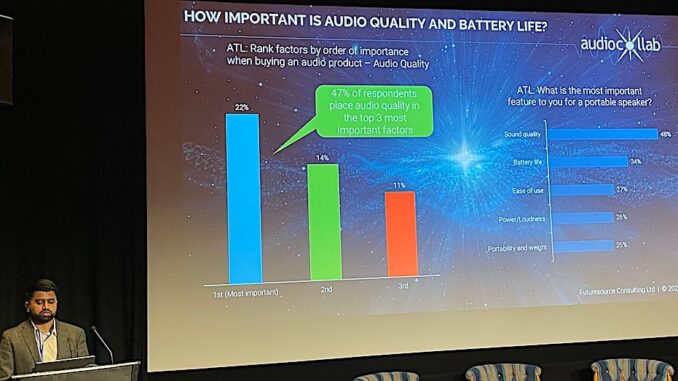

Factors driving growth are (1) sound quality, (2) battery life and (3) ease of use.

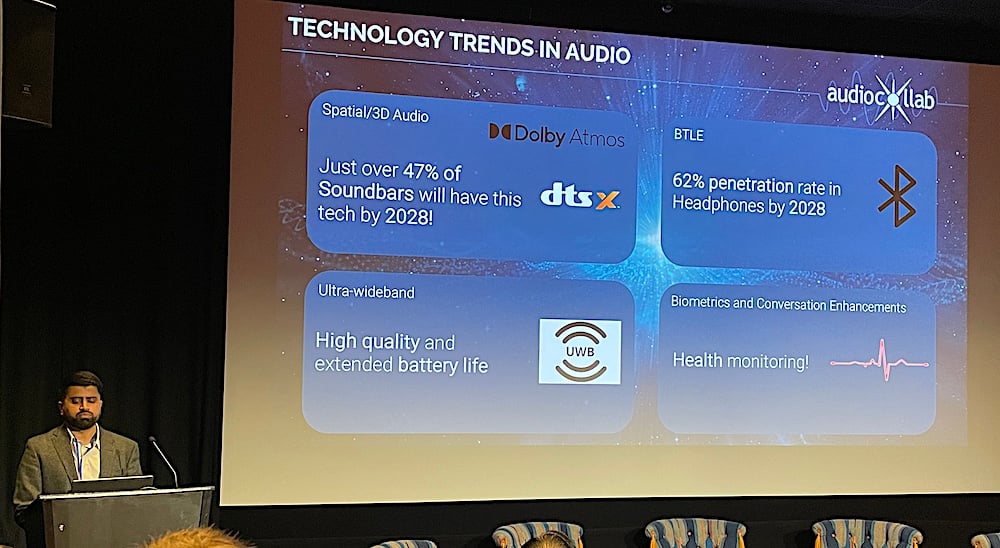

Technological innovation is rapidly changing the audio industry.

Spatial audio, Bluetooth Low Energy (BTLE), Ultra Wideband (UWB) and Biometrics are four key technologies that are driving change in products across the audio industry.

Spatial audio is becoming more prominent with spatial audio standards like Dolby Atmos becoming more prevalent within mass-market devices. Over 47% of soundbars are expected to support spatial audio by 2028.

Bluetooth Low Energy is enabling products to connect to more devices at once, while increasing battery life performance, enabling consumers to wear devices for longer while switching easily between audio sources.

Ultra Wideband is a very low power wireless technology that can deliver high quality audio transmission. Its use within the headphone segment is aiming to achieve audio streaming quality comparable to wired headphones.

Biometrics is in its early stages with integration into audio products but has emerged as a trend in 2024. Brands are placing multiple biometric sensors into headphones, which in combination with artificial intelligence, provides consumers more health tracking capabilities. This has been most prominent in Apple’s release of its newest Airpods Pro.

TWS (True Wireless Stereo) is fuelling headphone growth.

The True Wireless Stereo (most commonly known as wireless earbuds) category represents 70% of the headphones market segment and is the key driver of headphones growth.

The sector is also being propelled by growth in Over-Ear headphones which represent $12bn in value while In-Ear Wired products continue to decline with sales totalling $2bn.

TWS growth is expected to slow between 2024 and 2028 as the market reaches saturation and product quality increases in the direction of more durability and repairability.

Over-ear headphones are making a comeback.

Growth in Over-Ear headphones has made a comeback since 2023. Sony is the biggest brand operating in this category, while new entrants like Sonos, which released its first headband product earlier this year, are also fuelling category growth.

Consistent product innovation in over-ear headphones including features like spatial audio, ANC (active noise cancellation) and conversation enhancement technologies is driving consumer demand in this category. Consumers are willing to invest more in their Over-Ear Headphones for these features, along with better durability and battery life.

Home audio is readjusting after a pandemic boom.

The home audio segment is expected to decline by 2% in 2024, with bluetooth speakers representing the only expanding product category at 4% year on year growth.

Within home audio, wireless speakers are the dominant category representing $16bn in value, while soundbars and hi-fi systems trail at $6bn and $1bn respectively.

Audio Collaborative is an annual audio industry conference that brings together industry experts to analyse trends and market insights from across audio.